Outline

- Introduction

- Background and context

- Key features and content

- Concluding Commentary

1) INTRODUCTION

On March 30, 2022, the federal government released the new 2030 Emissions Reduction Plan: Canada’s Next Steps for Clean Air and a Strong Economy (ERP or the Plan)[1]. While this is not the first climate plan in this country, it may be the most significant. After decades of rising emissions, missing emission reduction targets, and insufficient or non-existent federal plans, this ERP and the associated contemporary context are different. It is, for example, the first ERP released pursuant to requirements of the new Net-Zero Emissions Accountability Act (NZEAA).[2] It also arrives in a context where the federal carbon pricing backstop is firmly part of the picture, recently confirmed as constitutionally valid by the Supreme Court of Canada. And, notwithstanding several shortcomings and many ‘plans to make plans’, on its face this ERP is perhaps the most ambitious ever released by the federal government.

This article provides a high-level review of the ERP. It begins with a short discussion of the contemporary context and the backdrop for the ERP. It then presents and reflects on key features and content of the ERP before then offering concluding commentary. Overall, the ERP can be seen as a significant development in federal climate (and energy) policy that — if implemented — will have far-reaching, long-term impacts. It is also, however, a plan that raises many questions and flags many steps that still need to be determined. As such, while the ERP is fit-for-purpose at the present time, future iterations — and implementation of those future plans — are likely to be more challenging and more important.

2) ERP BACKGROUND AND THE NZEAA CONTEXT

With the release of the ERP, the federal government has provided its latest overarching, comprehensive road map for reducing greenhouse gas (GHG) emissions en route to meeting Canada’s climate change commitments under the Paris Agreement (40–45% below 2005 levels by 2030) and beyond (net-zero by 2050). This is significant as it sets Canada’s climate change law and policy direction for decades to come. It is also fair to view the ERP as energy policy, as many measures have direct or indirect implications for extraction, transportation, and use of energy across all sectors across the country. Much of the content of the ERP is not new or surprising. Many measures have been set out in previous announcements, such as those made at COP26,[3] or in previous reports submitted to the UNFCCC secretariat.[4] However, the ERP contains perhaps the most detailed and comprehensive bird’s eye view ever released.

This ERP is also the first released under the new Net-Zero Emissions Accountability Act (NZEAA). The overarching purpose of the NZEAA is to provide a framework of accountability and transparency to deliver on Canada’s commitment to achieve net-zero greenhouse gas emissions by 2050.[5] As part of that framework, the NZEAA requires the government to set national emission reduction targets and to put in place plans for achieving those targets. The NZEAA requires the government to release this first ERP no later than 29 March 2022,[6] and section 10(1) of that Act sets out explicit requirements that the ERP must contain:

(a) the greenhouse gas emissions target for the year to which the plan relates;

(a.1) a summary of Canada’s most recent official greenhouse gas emissions inventory and information relevant to the plan that Canada submitted under its international commitments with respect to climate change;

(b) a description of the key emissions reduction measures the Government of Canada intends to take to achieve the greenhouse gas emissions target;

(b.1) a description of how Canada’s international commitments with respect to climate change are taken into account in the plan;

(c) a description of any relevant sectoral strategies;

(d) a description of emissions reduction strategies for federal government operations;

(e) a projected timetable for implementation for each of the measures and strategies described in paragraphs (a) to (d);

(f) projections of the annual greenhouse gas emission reductions resulting from those combined measures and strategies, including projections for each economic sector that is included in Canada’s reports under the Convention; and

(g) a summary of key cooperative measures or agreements with provinces and other governments in Canada.

While not structured in strict alignment with these requirements, the ERP contains all the requisite content.[7] Notably, the ERP also includes an interim objective for 2026 (20% below 2005 levels by 2026),[8] which is a requirement introduced late in the NZEAA legislative process.[9] Looking ahead, the federal minister is required to set subsequent emission reduction targets for every five years up until 2050,[10] and must in due course establish an ERP for each of those targets.[11] In light of that path ahead, this initial ERP is particularly important as it sets a precedent for what future plans could or ought to look like. As such, the ERP is a key early step as the new NZEAA regime takes hold. The balance of this article focuses on the contents of this first ERP.

3) KEY FEATURES AND CONTENT OF THE ERP

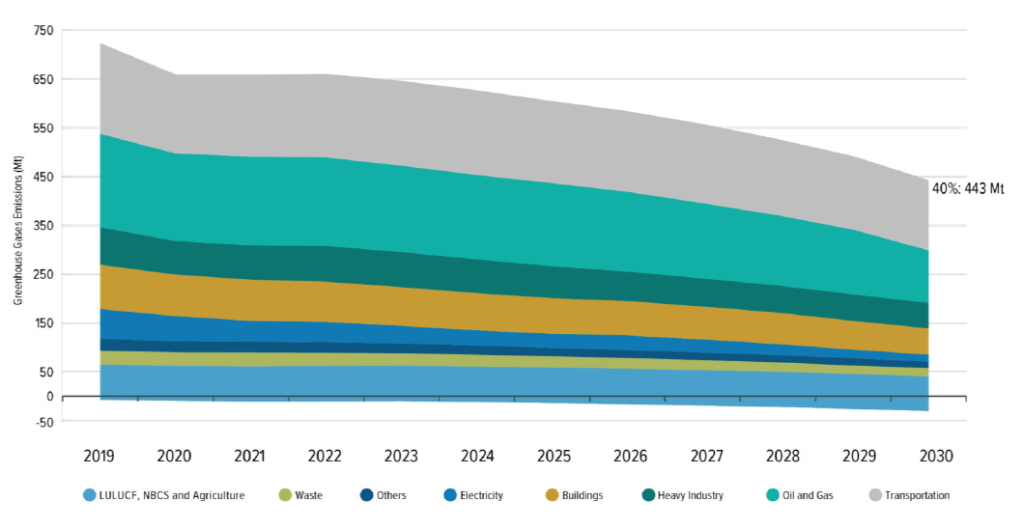

Viewed at a high level, the ERP represents an application of long-standing “wedge theory” of GHG emission reductions[12] — i.e. reductions are required from many different sectors using many different law and policy tools. Each of those wedges represent an opportunity for emissions reduction (or, in the long term in some cases, elimination). Figure 1[13] demonstrates how such wedges are depicted in the Canadian context by the ERP.

Figure 1: Pathway to 2030

These wedges can also be thought of as portions of the overall emissions pie chart, which is one way the ERP depicts Canada’s GHG emissions (Figure 2)[14].

Figure 2: Breakdown of Canada’s Greenhouse Gas Emissions by Economic Sector (2019)

The ERP contains detailed chapters focused on economy-wide measures, buildings, electricity, heavy industry, oil and gas, transportation, agriculture, waste, nature-based solutions, clean technology and climate innovation, sustainable finance, and sustainable jobs, skills and communities. Notably, particularly for the purposes of complying with NZEAA requirements, the ERP also includes information on emissions projections and associated modelling, as well as provincial and territorial collaboration. In the interest of succinctness, the following discussion focuses on particularly notable features from a climate and energy regulatory perspective, rather than walking through details of each chapter and associated measures.

Economy Wide Measures

Carbon Pricing

The federal carbon pricing regime put in place under the Greenhouse Gas Pollution Pricing Act (GGPPA)[15] figures prominently in the ERP, including mention of the Supreme Court of Canada’s recent upholding of the constitutionality of the regime under the federal Peace, Order and Good Government power.[16] ERP content regarding carbon pricing is substantially similar to what was already in the public domain. In particular, the Plan includes confirmation that starting in 2023 the price will start rising by $15 per tonne, per year until it reaches $170 per tonne in 2030.[17] As noted in the Plan, this provides price certainty for the foreseeable future. Of course, given the benchmark approach of the GGPPA, this of course requires that provinces and territories update their respective pricing systems to keep pace. And it will remain the case that the federal system will apply in provinces and territories without their own pricing systems.[18]

One new carbon pricing development from the ERP is directed at augmenting the federal regime in service of the stated desire for certainty. The Plan states, “the Government of Canada will explore measures that help guarantee the future price of carbon pollution”.[19] It goes on to indicate that this may include “investment approaches like carbon contracts for differences, which enshrine future price levels in contracts between the government and low-carbon project investors, thereby de-risking private sector low-carbon investments”.[20] It remains to be seen what these measures will look like in practice, though a helpful reference point for that work is a 2021 article by economists Dale Beugin and Blake Shaffer where they explain the general concept whereby the Canada Infrastructure Bank “shares risk by signing up for the value of a project that comes from the rising carbon price. Should policy get more stringent over time, those benefits accrue to the CIB; should government relax or remove carbon pricing, the CIB bears the loss”.[21]

Beyond such measures, the ERP also indicates that the government will be “exploring legislative approaches to support a durable price on carbon pollution”.[22] Additionally, the ERP indicates that the government is exploring carbon border adjustments as a potential complimentary policy tool — i.e. a mechanism “to account for differences between countries in carbon costs incurred in producing emissions-intensive goods that are traded internationally”.[23]

In short, on the matter of carbon pricing, the ERP clearly indicates the government’s intention to increase the price while entrenching it more deeply in the economy through targeted complementary tools. For those seeking certainty on this matter, the Supreme Court of Canada judgement and the contents of this ERP should provide strong assurances, notwithstanding political rhetoric that the topic continues to stimulate.

Methane

Building on announcements in fall 2021, the ERP confirms that the government is developing “more stringent regulations to achieve at least a 75 per cent reduction in methane emissions from the oil and gas sector by 2030”.[24] These will increase the stringency of the existing Regulations Respecting Reduction in the Release of Methane and Certain Volatile Organic Compounds (Upstream Oil and Gas Sector)[25] under the Canadian Environmental Protection Act, 1999 (CEPA, 1999).[26] The ERP also states: “regulations and other measures are being developed and consulted upon to address methane emissions from landfills and support the diversion of organics from landfills across the country”.[27] This means more methane regulatory measures are coming. All of this and more, the ERP indicates, will be presented in a forthcoming federal methane emissions reduction plan,[28] which presumably will flow from the March 2022 federal discussion paper.[29]

Clean Fuel Regulations

While not new, the ERP confirms that the proposed federal Clean Fuel Regulations[30] are a first step, and that the government is still “consulting on the Clean Fuel Regulation to ensure it continues to play a meaningful role in the decarbonization of the transportation sector, driving investments in clean fuels and zero-emissions vehicle technology” and that it is also consulting on “increasing the stringency of the Clean Fuel Regulations”.[31]

Together, the ERP content regarding methane regulations and clean fuel regulations clearly indicate that the federal government will continue to actively use direct regulation as a key tool for driving emissions reductions. A future example of such direct regulation is likely to be a cap on oil and gas emissions, which is discussed further below.

Electricity

The most notable ERP content on electricity is the focus on developing a Clean Electricity Standard (CES) “to support a net-zero electricity grid by 2035”.[32] Details in the ERP are thin, but more can be found in the government’s March 2022 discussion paper entitled, “A Clean Electricity Standard in support of a net-zero electricity sector”.[33] The paper indicates that the Clean Electricity Standard will also be under CEPA, 1999. One particular dimension to watch is whether electricity may be moved out of its current inclusion under the output-based pricing system of the GGPPA and into this other regime. This is mentioned very briefly in the discussion paper[34] but not the ERP. Consultations on the CES were underway at the time of the ERP’s release.[35]

Beyond the future CES work, the ERP primarily outlines planned federal support for “non-emitting energy” and “clean power”.[36] This includes significant resources for renewables, grid modernization, and net-zero energy plans, as well as resourcing to create a new “Pan-Canadian Grid Council”.[37] While ambiguous (like so many things are in the ERP), the Plan also indicates general support for “de-risking and accelerating the development of transformational, nation-building inter-provincial transmission lines”.[38] It also repeats the government’s commitment to implementing the Small Modular Reactor Action Plan, which was launched in December 2020.[39]

Surprisingly, the ERP’s electricity chapter does not set out a comprehensive vision or plan for the role of electrification in the broader decarbonization agenda. Many measures and initiatives are set out, but they lack cohesion. While this is, to some extent, understandable given federal jurisdictional constraints, one would reasonably expect more clarity on the federal role and the bigger picture. This is a significant shortcoming, considering the importance of electrification going forward[40] (though the ERP does include some further discussion in the transportation chapter).

Oil and Gas

The ERP’s chapter on oil and gas contains one of the most anticipated and attention-grabbing items: a commitment to capping and cutting emissions from the oil and gas sector “at the pace and scale needed to get to net zero by 2050”.[41] This was not a surprise, as the federal government had previously announced it, including at COP26,[42] and the work is now well underway. For example, the House of Commons Standing Committee on Natural Resources commenced a study on the matter in February 2022.[43] Details remain to be seen; however, from a legal perspective, the most likely route is via direct regulation under CEPA, 1999,[44] which the federal government has used effectively (and constitutionally) in relation to coal-fired power generation, vehicle emissions, and methane, as discussed above. The ERP does offer some contour at this stage, namely that “the intent of the cap is not to bring reductions in production that are not driven by declines in global demand,” and that downstream emissions (i.e. combustion of exported oil and gas, also referred to as “scope 3 emissions”) will not be regulated.[45]

In terms of expected emission reductions, the ERP indicates that the reductions expected of the oil and gas sector could be as much as 42% below current levels by 2030 (or 31% below 2005 levels by 2030),[46] and net zero emissions by 2050. The latter is consistent with the existing commitment of the Oil Sands Pathways to Net Zero initiative, which represents 95% of Canada’s oil sands production.[47]

The ERP also indicates that the sector’s transition will be assisted through a carbon capture, utilization, and storage (CCUS) tax credit,[48] which was then included in the latest federal budget.[49] The basic concept is for the credit to offset the costs of purchase and installation of eligible equipment. According to the government, the credit will be available starting in 2022,[50] though the rate of the credit is still to be determined. Preliminary indications of 50–60% have been met with criticism from industry,[51] while at the same time any credit of this type for the oil and gas sector has received significant criticism from some experts.[52] Presumably this tax credit will be in final form and appear as part of the broader CCUS Strategy that the government has committed to releasing in 2022.[53]

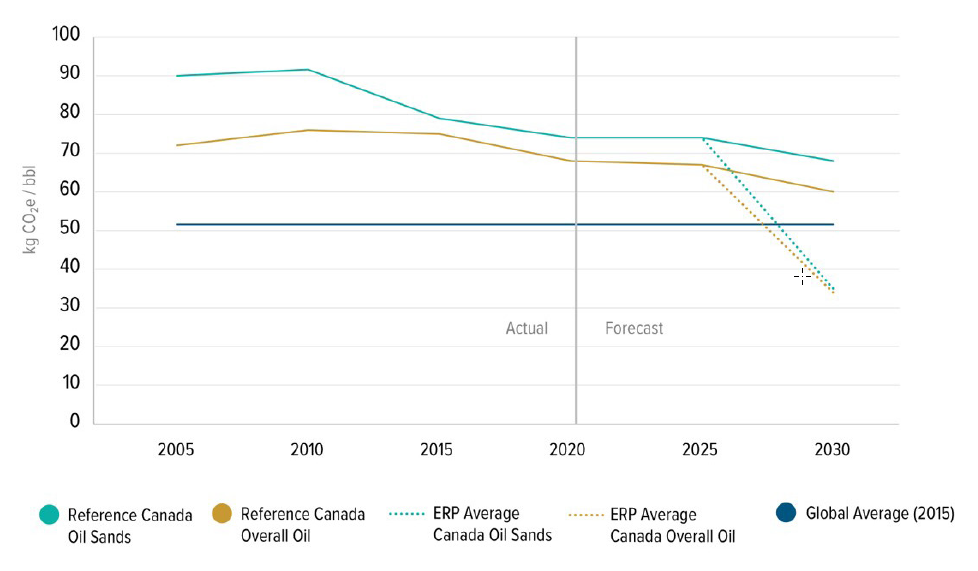

Controversy around the tax credit notwithstanding, the ERP sends a strong signal to Canada’s oil and gas sector that the time for any complacency is now over. The Plan points to Canada’s worse-than-global-average performance on carbon emissions (Figure 3) and underscores the magnitude of the challenge ahead. Law will now take the place of non-binding voluntary corporate commitments, essentially locking in a minimum for emission reduction performance, and compliance will be required. Canada’s oil and gas sector faces a momentous transition in the years and decades ahead, though the government is clearly working hard to ease this transition through exclusion of downstream emissions, allowing access to offsets,[54] creation of the tax credit, and any other potential measures to come. This assistance with the transition is not surprising, though some of it could be characterized as fossil fuel subsidies arriving at a time when there are government commitments to move away from such.[55] If there is policy consistency and coherence here, it would be that the government trying to thread the needle by providing industry support that does not constitute they type of “inefficient fossil-fuel subsidies that encourage wasteful consumption” that is supposed to be phased out.[56]

Figure 3: Canada Oil Intensity vs Global Average

(ERP Figure illustrating Canadian oil sands and overall Canadian oil emissions intensive in relation to global average)[57]

Transportation

The ERP describes a vision of ambitious electrification of Canada’s transportation sector, particularly with respect to light duty vehicles (LDVs) and medium and heavy duty vehicles (MHDVs). The two most notable future initiatives include: developing a “light duty vehicles ZEV sales mandate, which will set annually increasing requirements towards achieving 100% LDV ZEV sales by 2035, including mandatory interim targets of at least 20% of all new LDVs offered for sale by 2026 and at least 60% by 2030”; and developing “a MHDV ZEV regulation to require 100% MHDV sales to be ZEVs by 2040 for a subset of vehicle types based on feasibility, with interim 2030 regulated sales requirements that would vary for different vehicle categories based on feasibility, and explore interim targets for the mid-2020s”.[58] This shift to almost total electrification is significant because these two classes of vehicles account for more than two thirds of all of Canada’s transportation emissions.[59]

The ERP also sets out commitments to significant resources in support of ZEVs and decarbonization of the transportation sector. These include resources for ZEV purchase incentives and charging infrastructure, as well as investments in public and active transportation, greening the federal fleet, and various support for reducing emissions from trucking (e.g. hydrogen).[60] These commitments are further detailed in Budget 2022.[61] While details are scant, the ERP also indicates more work to come in relation to rail, aviation, marine, off-road, and other aspects of the transportation sector.[62]

Modelling

A long-standing issue in climate law and policy is the transparency and accuracy of the modelling behind the projected emissions reductions associated with any given measure or suite of measures. The saying, “all models are wrong, but some are useful”[63] is consistently apt. The ERP takes a significant step toward increased transparency on this front by including a chapter on projections. The chapter explains the methodology used in calculating expected emissions reductions and how those reductions contribute to meeting the 2030 commitment.[64] It also sets out expected emission reductions by sector, which is a useful bird’s eye view. For example, this is where one finds the figure of 31% below 2005 levels by 2030 for the oil and gas sector.[65] It also indicates, for example, a reduction of 88% below 2005 levels from the electricity sector.[66]

The ERP also commits to enhancing transparency in modelling approaches. The government will, for example, “convene an expert-led process to provide independent advice in time for the 2023 Progress Report, enhancing the current robust and reliable modelling regime to inform the basis of future ERPs”.[67] This commitment and associated actions is in response to advice from the federal Net-Zero Advisory Body.[68] It also takes a step toward addressing concerns voiced in the past by the federal Commissioner of the Environment and Sustainable Development who has previously recommended that the government “should provide greater access to model inputs, assumptions, and outputs, as well as details about the way policies are modelled”.[69] The Commissioner very recently reiterated this type of concern in his Spring 2022 report in relation to the potential of hydrogen to reduce emissions, finding that government departments “used unrealistic assumptions”.[70] While an assessment of the ERP projections by the Canadian Climate Institute concluded that the ERP “includes more transparency on the modelling and analysis used to develop the projections than we’ve seen before” and that the ERP policy package “puts Canada on a path to achieve the 2026 objective and very close to achieving the 2030 objective”,[71] this will certainly be a critically important aspect going forward.

Cooperation and Jurisdiction

It is well known that federalism presents a fundamental challenge to climate change law and policy in Canada. While the federal government has ample jurisdiction to regulate GHG emissions,[72] it does not have plenary power over the matter. Constitutional constraints mean cooperation with provinces and territories is essential on the path to achieve emission reduction commitments. Overall, the measures and next steps outlined in the ERP represent the federal government taking an “all of the above” approach to deploying jurisdictionally tenable law and policy levers while being vigilant in observing constitutional constraints.

The ERP also fulfills its purpose (and the NZEAA requirement) of setting out cooperative measures and agreements with the provinces and other governments in Canada. In particular, the chapter on “collaborating on climate change mitigation” and the annex of provincial and territorial submissions present this content comprehensively.[73] However, while this is useful information and appears to satisfy the NZEAA, it is not completely clear how emission reductions from provincial and territorial measures factor into the ERP’s projections. This aspect is mentioned briefly,[74] but stands out as an aspect for improvement in future ERPs, likely as part of the abovementioned government commitment to improved transparency in modelling, jurisdictional complexities notwithstanding.

4) CONCLUDING COMMENTARY

In reports of 2012 and 2014, the federal Commissioner of the Environment and Sustainable Development found that the federal government had no overarching plan for how to achieve emission reduction commitments.[75] There was no place that set out “what the government is trying to achieve in quantitative terms and what specific steps it will take to get there”.[76] Viewed against that baseline, the ERP represents a significant step forward. It is a comprehensive roadmap that charts a reasonably credible path to Canada’s 2030 emission reduction target and beyond to net zero in 2050. Future specific measures and mechanisms notwithstanding, the ERP provides macro-level price and policy certainty that will likely be welcomed by many, even if reluctantly in some corners. It also provides an early signal that the NZEAA is having its intended effect, even if that task is relatively straightforward during the tenure of the same government that introduced the Act.

However, as noted in the foregoing discussion, an immense amount of work is left to do. A significant amount of the ERP content is essentially planning to do more planning. While that is understandable given that it is an overarching document, this underscores that follow-through and policy consistency is critical from here forward. Climate change law and policy is a story of a long-standing and ever-increasing gap between glossy plans on paper and actual emission reductions in the real world. The ERP charts a bridge across that gap for Canada with an unprecedented degree of detail, ambition, and comprehensiveness. However, there will be an ever-present risk of derailment by devilish details, jurisdictional battles, claims of unfairness, technical complexities, and shifting political winds. Unfortunately, if abandoned or even unimplemented to any substantial degree (without equivalent policies introduced), the ERP will only serve as the latest and starkest example of a highly developed country failing to follow-through in a context where time and fairness are of the essence. The ERP was released into a high stakes context, and those stakes will remain high for decades to come. In coming months and years, the world will see whether Canada can finally move beyond the easy step of making commitments and onto the difficult and unprecedented step of acting to dramatically reduce GHG emissions.

* Associate Professor and Member of the Natural Resources, Energy & Environmental Law Research Group, Faculty of Law, University of Calgary. Sincere thanks to colleagues for input on a previous draft. Any errors are the author’s alone.

- Environment and Climate Change Canada, 2030 Emissions Reduction Plan: Canada’s Next Steps for Clean Air and a Strong Economy, Catalogue No En4-460/2022E-PDF (Gatineau: Environment and Climate Change Canada, 2022) [ERP], online (pdf): <www.canada.ca/content/dam/eccc/documents/pdf/climate-change/erp/Canada-2030-Emissions-Reduction-Plan-eng.pdf>.

- Canadian Net-Zero Emissions Accountability Act, SC 2021, c 22 [NZEAA].

- See David V Wright, “Reflection on COP26 and the Glasgow Climate Pact”, (2022) 125 Resources 1, online (pdf): <cirl.ca/sites/default/files/Resources/Resources125.pdf> (for discussion of COP26 developments and announcements relevant to Canada).

- See e.g. Environment and Climate Change Canada, Canada’s Fourth Biennial Report on Climate Change, Catalogue No En4-73/2020E-PDF (Gatineau: Environment and Climate Change Canada, 2022), online (pdf): <unfccc.int/sites/default/files/resource/br4_final_en.pdf>.

- “Canadian Net-Zero Emissions Accountability Act” (last modified 29 March 2022), online: Canada.ca <www.canada.ca/en/services/environment/weather/climatechange/climate-plan/net-zero-emissions-2050/canadian-net-zero-emissions-accountability-act.html>.

- NZEAA, supra note 2, s 9(2) (requiring that the minister release the plan within six months after the NZEAA came into force), s 9(3) (allowing for a 90-day extension, which was the case here). See also ERP, supra note 1 at 19.

- See Dave Sawyer et al, Independent Assessment: 2030 Emissions Reduction Plan, Canadian Climate Institute (April 2022) at 6, online (pdf): <climateinstitute.ca/wp-content/uploads/2022/04/ERP-Volume-2-FINAL.pdf> (indicating that the ERP does what the NZEAA requires it to do).

- ERP, supra note 1 at 88.

- The requirement for this target is included in NZEAA, supra note 2, s 9(2.1). See Rosa Galvez, “A Short Guide to the Canadian Net-Zero Emissions Accountability Act (CNZEAA)” (last visited 5 May 2022), online: Senator Rosa Galvez <rosagalvez.ca/en/initiatives/climate-accountability/short-guide-to-the-cnzeaa/>.

- NZEAA, supra note 2, s 7(4).

- NZEAA, supra note 2, s 9(1).

- See S Pacala & R Socolow, “Stabilization Wedges: Solving the Climate Problem for the Next 50 Years with Current Technologies” (2004) 305:5686 Science 968, online (pdf): <cmi.princeton.edu/wp-content/uploads/2020/01/Stabilization_Wedges_-Solving_the_Climate_Problem_for_the_Next_50_Years_with_Current_Technologies_Science.pdf>; Robert Socolow, “Wedges reaffirmed” (27 September 2011) Bulletin of the Atomic Scientists, online (pdf): <cmi.princeton.edu/wp-content/uploads/2020/01/Wedges_reaffirmed_-_Bulletin_of_the_Atomic_Scientists.pdf>.

- ERP, supra note 1 at 88.

- ERP, supra note 1 at 11.

- Greenhouse Gas Pollution Pricing Act, SC 2018, c 12, s 186 [GGPA].

- ERP, supra note 1 at 24. See References re Greenhouse Gas Pollution Pricing Act, 2021 SCC 11.

- ERP, supra note 1 at 25, 27.

- See Ibid at 25 (map of current application).

- Ibid at 9, 27.

- Ibid.

- Memorandum from Dale Beugin & Blake Shaffer to Infrastructure Minister Catherine McKenna (4 June 2021) “Re: The Climate Policy Certainty Gap and How to Fill It”, online (pdf): <www.cdhowe.org/sites/default/files/IM-Buegin%20and%20Shaffer_2021-0603_0.pdf>.

- ERP, supra note 1 at 27.

- Ibid at 27.

- Ibid at 32.

- Regulations Respecting Reduction in the Release of Methane and Certain Volatile Organic Compounds (Upstream Oil and Gas Sector), SOR/2018-66.

- Canadian Environmental Protection Act, 1999, SC 1999, c 33 [CEPA, 1999].

- ERP, supra note 1 at 32.

- Ibid.

- Environment and Climate Change Canada, Reducing Methane Emissions from Canada’s Oil and Gas sector, (Discussion Paper) (Gatineau: Environment and Climate Change Canada, 2022), online (pdf): <www.canada.ca/content/dam/eccc/documents/pdf/cepa/20220325_OilGasMethaneDD-eng.pdf>.

- “What is the clean fuel standard?” (last modified 20 January 2022), online: Canada.ca <www.canada.ca/en/environment-climate-change/services/managing-pollution/energy-production/fuel-regulations/clean-fuel-standard/about.html>.

- ERP, supra note 1 at 30.

- Ibid at 42.

- Environment and Climate Change Canada, A Clean Electricity Standard in support of a net-zero electricity sector, (Discussion Paper) (Gatineau: Environment and Climate Change Canada, 2022), online (pdf): <www.canada.ca/content/dam/eccc/documents/pdf/cepa/CleanElectricityStandardDiscussionPaper-eng.pdf>.

- Ibid at 5.

- Environment and Climate Change Canada, News Release, “Canada launches consultations on a Clean Electricity Standard to achieve a net-zero emissions grid by 2035” (15 March 2022), online: Canada.ca <www.canada.ca/en/environment-climate-change/news/2022/03/canada-launches-consultations-on-a-clean-electricity-standard-to-achieve-a-net-zero-emissions-grid-by-2035.html>.

- ERP, supra note 1 at 42.

- Ibid.

- Ibid.

- Ibid at 41–42. See also “Canada’s Small Modular Reactor Action Plan” (15 February 2022), online: NRCAN.gc.ca <www.nrcan.gc.ca/our-natural-resources/energy-sources-distribution/nuclear-energy-uranium/canadas-small-nuclear-reactor-action-plan/21183>.

- See Richard Florizone & Susan McGeachie, “Electrification is Canada’s advantage in the race to net zero” (19 January 2022), online: iPolitics <ipolitics.ca/news/electrification-is-canadas-advantage-in-the-race-to-net-zero> (discussing importance of electrification).

- ERP, supra note 1 at 52.

- Wright, supra note 3.

- “Greenhouse Gas Emissions Cap for the Oil and Gas Sector” (last accessed 5 May 2022), online: House of Commons <www.ourcommons.ca/Committees/en/RNNR/StudyActivity?studyActivityId=11468847>.

- See Brief from Martin Olszynski to Standing Committee on Natural Resources “Re: Study of the proposal for a greenhouse gas emissions cap on the oil and gas sector” (17 February 2022), online (pdf): <www.ourcommons.ca/Content/Committee/441/RNNR/Brief/BR11637864/br-external/OlszynskiMartin-e.pdf>.

- ERP, supra note 1 at 195.

- ERP, supra note 1 at 8, 48.

- “We need to get to net-zero” (last visited 5 May 2022) online: Oil Sands Pathways <www.oilsandspathways.ca/#net-zero>.

- ERP, supra note 1 at 9, 51, 53.

- “Investment Tax Credit for Carbon Capture, Utilization, and Storage” (last modified 3 December 2021), online: Canada.ca <www.canada.ca/en/department-finance/programs/consultations/2021/investment-tax-credit-carbon-capture-utilization-storage.html>.

- Ibid.

- The Canadian Press, “Federal tax credit not enough to get carbon capture projects built, Cenovus CEO says”, CBC (27 April 2022), online: <www.cbc.ca/news/canada/calgary/cenovus-energy-reports-1-6b-first-quarter-profit-triples-dividend-1.6432431>.

- Mia Rabson, “Hundreds of academics ask Freeland to scrap carbon capture tax credit”, CTV (20 January 2022), online: <www.ctvnews.ca/climate-and-environment/hundreds-of-academics-ask-freeland-to-scrap-carbon-capture-tax-credit-1.5747401>.

- ERP, supra note 1 at 78.

- Ibid at 53 (indicating that “[t]he sector may need time – limited flexibilities, for example using domestic or international offsets…”). The ERP also indicates that the federal government is currently in the process of developing policy on use of “internationally transferred mitigation outcomes” as part of the international emissions offset regime at 104.

- See Rachel Samson, Peter Phillips & Don Drummond, “Cutting to the Chase on Fossil Fuel Subsidies”, Canadian Institute for Climate Choices, (February 2022), online (pdf): <climatechoices.ca/wp-content/uploads/2022/02/Fossil-Fuels-Main-Report-English-FINAL-1.pdf>.

- Ibid (discussing this commitment and what it may mean).

- ERP, supra note 1 at 50.

- Ibid at 61.

- Ibid at 56.

- Ibid at 61.

- Transport Canada, News Release, “Minister of Transport announces the expansion of the Incentives for Zero-Emission Vehicles Program” (22 April 2022), online: Canada.ca <www.canada.ca/en/transport-canada/news/2022/04/minister-of-transport-announces-the-expansion-of-the-incentives-for-zero-emission-vehicles-program.html>.

- ERP, supra note 1 at 62.

- George Box & Norman Draper, “Empirical Model-Building and Response Surfaces” (New York: Wiley, 1987) at 424.

- ERP, supra note 1 at 87, Annex 5.

- Ibid at 88.

- Ibid at 89.

- Ibid at 91.

- Ibid at 91.

- Canada, Commissioner of the Environment and Sustainable Development, 2014 Fall Report of the Commissioner of the Environment and Sustainable Development, Catalogue No FA1-2/2014-1-0E-PDF, (Performance Audit), Chapter 1 – Mitigating Climate Change (Ottawa: Office of the Auditor General of Canada, 2014) at 1.43 – 1.57 [Audit 2014], online: OAG-BVG.gc.ca <www.oag-bvg.gc.ca/internet/english/parl_cesd_201410_01_e_39848.html>.

- Canada, Commissioner of the Environment and Sustainable Development, Report 3—Hydrogen’s Potential to Reduce Greenhouse Gas Emissions, Catalogue No FA1-26/2022-1-3E-PDF (Ottawa: Office of the Auditor General of Canada, 2022) at 3.16, online: OAG-BVG.gc.ca <www.oag-bvg.gc.ca/internet/English/parl_cesd_202204_03_e_44023.html>.

- Sawyer, supra note 7 at 11.

- See Nathalie J. Chalifour, “Canadian Climate Federalism: Parliament’s Ample Constitutional Authority to Legislate GHG Emissions through Regulations, a National Cap and Trade Program, or a National Carbon Tax” (2016) 33 NJCL 331 at 361, online (pdf): <papers.ssrn.com/sol3/papers.cfm?abstract_id=2775370>; Alastair R Lucas & Jenette Yearsley, “The Constitutionality of Federal Climate Change Legislation” (2011) 4:15 SPP Research Papers, online (pdf): <journalhosting.ucalgary.ca/index.php/sppp/article/download/42369/30265/110948>.

- ERP, supra note 1 at 95–104.

- Ibid at 87.

- Audit 2014, supra note 69 at 1.36.

- Ibid at 1.37.