Throughout 2016, a number of key developments directly affected Alberta’s power sector. Most of these developments arose in connection with the implementation of the Climate Leadership Plan1 (“Climate Plan”) by the Government of Alberta (the “Province”). The Climate Plan was originally announced in November of 2015, and, among other things, it promised an economy-wide carbon price and a legislated cap on oil sands emissions.

For the power sector, the driving objective set out in the Climate Plan is to phase out emissions from coal-fired generation by 2030. Two-thirds of the existing electricity produced from coal is intended to be replaced with electricity from renewable sources and one-third with natural gas. To date, the Province has taken a number of steps toward achieving these goals. Significantly, on November 23, 2016, the Province announced the restructuring of Alberta’s electricity market, from a fully deregulated regime to a hybrid system that incorporates capacity payment mechanisms.2

This article provides a high-level overview of the recent developments in Alberta, including a summary of the initiatives arising out of the Climate Plan, followed by a more detailed discussion of the Alberta Electric System Operator’s (“AESO”) initiative to develop a new capacity electricity market.

1. Current Market Snapshot

Alberta is one of the few jurisdictions in the world with an “energy-only” market. This means that Alberta generators only recover the wholesale price of electricity. Investors are only able to recover invested capital if they can leverage high-priced hours, and in this way, the energy-only system contains the risk of supply instability and may not promote investment in generation facilities and, in particular, renewable energy sources.

The following are some key statistics of Alberta’s electricity market:3

- Approximately 39 per cent of Alberta’s installed electricity generation capacity is from coal, almost 44 per cent is from natural gas, nine per cent is from wind, and the remaining capacity is from water, biomass and waste heat forms of generation.

See figure 1 below.

Figure 1

Source: AESO, Electricity in Alberta, as of August 2016.

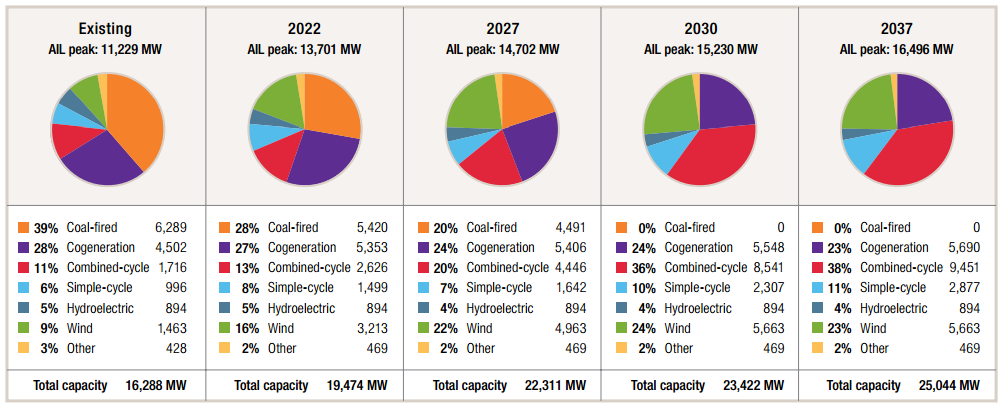

- As of May 2016, the AESO estimated the changes depicted below to Alberta’s future generation capacity based on the anticipated policy changes.4 Although the estimates are based on the assumption of 4,200 megawatts (“MW”) of installed renewable capacity, the Province subsequently announced a target of 5,000 MW from wind, solar and hydro projects by 2030.

See figure 2 below.

Figure 2

Source: AESO 2016 Long-term Outlook, as of May 2016.

2. The Climate Plan

As indicated above, for the power sector, the Climate Plan seeks to replace two-thirds of the existing coal-fired electricity with renewable energy and one-third with natural gas. To achieve its goals, the Province has taken a number of steps, including:

Phase-out of coal emissions by 2030: The Climate Plan’s goal is to replace these units with two-thirds renewable energy and one-third natural gas generation. The Province legislated its “30 by ‘30” target in the Renewable Electricity Act,5 which was tabled in November 2016. On November 24, 2016, Alberta announced its decision to provide transition payments to TransAlta Corporation, Capital Power Corporation, and ATCO Ltd., as part of the process to phase out coal-fired emissions on or before December 31, 2030. Under the proposed scheme, these three companies are expected to receive annual payments totaling $1.1 billion over the course of 2016 to 2030. The Province announced that these payments will not be funded by consumer electricity rates, but rather by Alberta’s carbon levy on industrial emissions.

Renewable Energy Program: The Renewable Electricity Act also empowers the AESO to administer a competitive bid process for its Renewable Electricity Program (“REP”). Under the REP, successful bidders enter into a Renewable Electricity Support Agreement (“RESA”) with the AESO, which will provide a twenty-year indexed renewable energy credit, structured akin to a Contract for Difference, to cover any difference between the participant’s bid price for the project and the pool price of energy in the market. The AESO officially launched the first competition (Round 1) of the REP on March 31, 2017 with a Request for Expressions of Interest (the REOI).6 In addition to continuing its stakeholder consultation and information sessions, the AESO released a revised draft of the RESA and provided the key dates for REP Round 1. The full form of RESA is expected to be released to project bidders during the Request for Qualifications Stage.

See figure 3 below.

Figure 3

Source: AESO, Request for Expressions of Interest for the First Renewable Electricity Program Competition REP Round 1, Section 2.1 at p 4.

Economy-wide carbon price: Changes in 2015 to the Specified Gas Emitters Regulation7 (“SGER”) significantly increased the cost of emissions for large industrial emitters (those that emit 100,000 tonnes or more of greenhouse gases). Such facilities are subject to the following costs of compliance under SGER:

| Site-specific emissions intensity reduction targets: | Emissions payments for each tonne over the facilities’ reduction targets: |

| 12% in 2015 | $15 in 2015 |

| 15% in 2016 | $20 in 2016 |

| 20% in 2017 | $30 in 2017 |

The Province also introduced a Carbon Competitiveness Regulation,8 basing emissions intensity credits on a comparison with the most efficient natural gas generator.

Province-wide carbon levy: On January 1, 2017, under the Climate Leadership Act, the Province imposed a province-wide carbon levy, with the purpose of “provid[ing] for a carbon levy on consumers of fuel to be effected through a series of payment and remittance obligations that apply to persons throughout the fuel supply chains.”9 The carbon levies are imposed upon various enumerated transactions across the fuel value chain. Revenues from the carbon levy will be used for: (i) initiatives to reduce greenhouse gas emissions, or more broadly, to support Alberta’s ability to adapt to climate change; or (ii) to fund rebates or adjustments related to the levies. Namely, carbon pricing revenue will be invested back into Alberta for clean research and technology, green infrastructure and to help finance the AESO’s REP. The Province announced that the carbon tax will also be used for an “adjustment fund” to help individuals and families adjust to the levy, and to help small business, First Nations and people working in the coal industry.

Legislated cap on oil sands emissions: The oil sands sector accounts for approximately one-quarter of Alberta’s annual emissions and these facilities are currently charged a levy based on each facility’s historical emissions under the SGER. On December 14, 2016, the new Oil Sands Emissions Limit Act10 came into force. This Act places a cap on emissions from oil sands production of 100 Megatonnes. The legislation also contemplates certain exceptions in respect of cogeneration emissions, upgrading emissions, and potential discretionary exemptions by regulation (likely to accommodate new technological developments). While the Act itself came into force, its regulations have not yet been developed and will be required to provide the full scope and application of this new legislation.

Methane emissions reduction plan: Alberta intends to cut methane emissions by 45 per cent from 2014 levels by 2025.11 The Province’s largest source of methane emissions is from the oil and gas industry (from venting, fugitive emissions from natural gas driven pneumatics and leaks, and flaring). The former Climate Change and Emissions Management Corporation, now Emissions Reduction Alberta (“ERA”), has earmarked a total of $40 million to help advance technologies to reduce methane emissions in Alberta, providing successful applicants with up to a maximum of $5 million.12 Project proposals were due on March 30, 2017 with ERA expected to release its decision in June of 2017.13

3. Alberta’s Capacity Market

Over the next 14 years, the Province has estimated that it will need up to $25 billion of new investment in electricity generation to support, in part, the growing electricity needs of the Province and to implement its plan to phase out coal-fired generation and meet its target of 30 per cent renewable electricity capacity by 2030.14

Accordingly, current and potential energy investors as well as the AESO have recommended that Alberta transition to a capacity power market regime, which is expected to promote stability in the price and supply of electricity and investment in energy. This recommendation can be found in the AESO’s report entitled, Alberta Wholesale Electricity Market Transition Recommendation15 (“AESO Capacity Report”).

Under the proposed market scheme, Alberta will incorporate mechanisms to compensate power producers for their generation capacity. Alberta’s electricity market will therefore be comprised of three separate markets: (i) a market for energy; (ii) the ancillary services market; and (iii) a market for capacity, in which generators will agree to have availability to supply electricity when required. Each of these markets produce separate revenue streams: (i) energy payments, which are paid to the generator for electricity that is purchased; and (ii) capacity payments, which are paid to the generator for making generation capacity available on demand.

a. Why the Transition to a Capacity Market?

By letter dated January 10, 2017,16 Alberta Energy requested that the AESO lead the technical design of the capacity market, including an evaluation of the AESO itself in order to identify necessary charges to the energy and ancillary services products markets, to ensure system reliability.17

Within the AESO Capacity Report, the AESO concluded that maintaining the status quo (i.e. no change to the current energy-only market rules, products or design) will not attract a sufficient amount of investment in firm, dispatchable generation to ensure an adequate supply as Alberta transitions away from coal and towards renewable generation.18 Upon landing on its recommendation for a capacity market, the AESO analyzed, with reference to the Province’s desired outcomes, the alternative options to remedy this failure. At a high level, Alberta Energy and the AESO’s desired outcomes are:

- A reliable and resilient system (i.e. compatibility with managing coal phase-out, compatibility with increased interties, integration of renewable generation and new technologies, variability of the reserve margin and sufficient supplied adequacy);

- Environmental performance (i.e. compatibility with the REP, resiliency of market to environmental policy, compatibility with increased cogeneration, energy efficiency, micro and distributed generation, carbon prices and future expansion of renewable energy);

- Reasonable costs to consumers (i.e. stable prices, reasonable cost of delivered energy, maintaining fair efficiency and openly competitive market operation, compatibility with changes to the regulated rate option, maintaining reasonable transmission costs, and fundamentally does not alter the market);

- Economic development and job creation (i.e. impact on trade exposed or key industries, enabling economic growth and achieving other social objectives such as support for particular demographics, locations or industrial policy); and

- An orderly transition (i.e. minimizing disruption and costs).

For context, the other options explored by the AESO included: (i) enhancements to the energy-only market (e.g. increasing the price cap from $1,000 to $5,000); (ii) long-term contracts like those implemented in Ontario; and (iii) the return to a regulated cost of service structure.

As discussed in detail within the AESO Capacity Report, the AESO ultimately recommended a capacity market because it:19

- Ensures reliability as Alberta’s electricity system evolves and will specifically compensate for firm generation;

- Increases stability of prices;

- Provides greater revenue certainty for generators;

- Maintains competitive market forces and drives innovation and cost discipline; and

- Supports implementation of Climate Leadership Plan initiatives and is adaptable to future policy evolution.

b. Timeline for the Capacity Market

- Alberta’s capacity market will be developed in consultation with stakeholders, and will be implemented by 2021.

- The AESO has estimated that the design of the market will take two years to complete, with an additional year to finalize legal contracts and to set up a procurement process.

- The first capacity contracts are expected to be formed at least three years after the design process begins.

- Accordingly, the earliest date that capacity procured through the initial auction would be in service will likely be in 2024.

4. Design of the Capacity Market – Issues and Developments to Monitor

The possible implications of the power market overhaul on Alberta’s energy landscape will need to be considered in light of other commitments recently announced by the Province, such as its renewable energy initiatives. At present, some issues to consider include:20

- Role of the Regulators: Achieving an orderly transition to a capacity market and its design and implementation will require legislative changes, regulatory rule making (i.e. new ISO Rules and Tariffs) and oversight by the applicable regulators. As such, Alberta’s electricity regulators and agencies, including the Alberta Utilities Commission (“AUC”), Alberta Market Surveillance Administrator and the Balancing Pool could play a greater role.

We anticipate that the AUC will play an important role, including with respect to both the market rule development process and facility applications. For example, as development activity continues in advance of future rounds of the REP and competitive capacity auctions, we anticipate a corresponding increase in the number of facility approval applications submitted to the AUC. During the AUC’s review and approval of the increasing number of facility applications, it will be interesting to watch how the AUC considers and addresses evidence regarding recurrent themes, including those related to noise, wildlife and health effects. Public involvement in energy infrastructure has been on the forefront of recent energy development and is of significant importance in Alberta and throughout Canada. An area to monitor is whether the AUC’s “directly affected” test21 for standing to participate in proceedings will remain or whether it will be changed to a more inclusive standard to foster greater public participation. - Price Stability: Although there are many direct benefits to consumers from capacity markets, such as the reduction of price spikes, consumers risk incurring increased costs. The Province recently announced its commitment to protecting consumers from volatile prices by implementing a price cap of 6.8 cents per kilowatt hour from June 2017 to June 2021.22 However, as the cap on electricity prices and the implementation of power capacity payments are unlikely to overlap, the implications of the capacity power market on consumer prices remains uncertain.

- Overlap and Interplay with Other Initiatives: How the capacity market will interact with the principles of the energy-only market and specifically the principles legislated within the Fair, Efficient and Open Competition Regulation23 (“FEOC”) will be critical to watch. Specifically, whether and how the FEOC principles will be applied to the various relationships between generators participating in the Alberta market, including the successful bidders from both the REP and the auction for capacity contracts, and how such incentives will be addressed with incumbent generators who already invested, built and operate natural gas and renewable generation facilities in Alberta should be carefully observed.

- Supply Reliability: The capacity market provides incentives for electricity generators to supply the power pool, as well as with the means to invest in renewable energy sources. It remains to be seen whether the market overhaul will remedy possible gaps in Alberta’s power supply, especially during the period of coal phase-out, and whether it will reinforce Alberta’s Climate Plan.

*Kim Howard is a senior associate with McCarthy Tetrault’s Calgary office and a member of the firm’s National Energy Practice Group. Kim’s area of focus includes regulatory and commercial requirements for new renewable power developments in Alberta and in other Western Canadian provinces.

**Gordon Nettleton is a partner with McCarthy Tetrault and co-leads the firm’s National Energy Regulatory Practice Group. He regularly appears before provincial and federal energy administrative tribunals and assists clients in matters that concern electricity and pipeline rates and facilities applications and issues involving Aboriginal and environmental law.

- Government of Alberta, Climate Leadership Plan (Edmonton: Alberta Environment and Parks, 20 November 2015), online: <https://www.alberta.ca/climate-leadership-plan.aspx>.

- Government of Alberta, Consumers to benefit from stable, reliable electricity market (Edmonton: 23 November 2016), online: <https://www.alberta.ca/release.cfm?xID=44880BD97DCDC-D465-4922-25225F9F43B302C9>.

- Government of Alberta, Energy Statistics (Edmonton: December 2015), online: <http://www.energy.gov.ab.ca/Electricity/682.asp>.

- AESO, AESO, 2016 Long-term Outlook, online: <https://www.aeso.ca/download/listedfiles/AESO-2016-Long-term-Outlook-WEB.pdf>.

- Bill 27, Renewable Electricity Act, 2nd Sess, 29th Leg, Alberta, 2016.

- AESO, Request for Expressions of Interest – For the First Renewable Electricity Program Competition REP Round 1 (Calgary: 31 March 2017), online: <https://www.aeso.ca/assets/Uploads/REP-Round-1-REOI-033117.pdf>.

- Specified Gas Emitters Regulation, Alta Reg 139/2007.

- Alberta, Climate Leadership Report to the Minister (Edmonton: Alberta Climate Change Advisory Panel, 2015), online: <http://www.alberta.ca/documents/climate/climate-leadership-report-to-minister.pdf>.

- Climate Leadership Act, SA 2016, c C-16.9, s 3.

- Oil Sands Emissions Limit Act, SA 2016, c O-7.5.

- Alberta, Climate Plan, Reducing Methane Emissions (Edmonton: Alberta Environment and Parks), online: <https://www.alberta.ca/climate-methane-emissions.aspx >.

- Alberta, Press Release, New “ERA” of Climate Innovation Targets Methane Pollution (Edmonton: Government of Alberta, 2016), online: <http://www.alberta.ca/release.cfm?xID=43663196ECDB0-D667-25D7-74C379B20D4BC055>.

- Emissions Reduction Alberta, Addressing the Methane Challenge – Full Project Proposal Guidelines (Edmonton: Government of Alberta), online: <http://www.eralberta.ca/apply-docs/era-methane-full-project-proposal-guidelines.pdf>.

- Government of Alberta, Electricity (Edmonton: Alberta Energy), online: <http://www.energy.alberta.ca/Electricity/electricity.asp>.

- AESO, Alberta Wholesale Electricity Market Transition Recommendation (Calgary: 2 October 2016), online: <https://www.aeso.ca/assets/Uploads/Albertas-Wholesale-Electricity-Market-Transition.pdf > (“AESO Capacity Report”).

- Government of Alberta, Letter to Mr. David Erickson, President and CEO of the AESO (Edmonton: 10 January 2017), online: <https://www.aeso.ca/assets/Uploads/capacity-market-design-AESO-mandate-letter-Jan-10-2017.pdf>.

- Ibid.

- AESO Capacity Report, supra note 15 at 16.

- AESO Capacity Report, ibid at 40-41.

- See also Kimberly Howard, Beverly Ma & George Vegh, “The New Current: Alberta Announced Overhaul of Electricity Market” Canadian Energy Perspectives, Developments in Energy and Power Law (24 November 2016), online: Canadian Energy Perspectives Blog <http://www.canadianenergylawblog.com/2016/11/24/the-new-current-alberta-announces-overhaul-of-electricity-market/>.

- Alberta Utilities Commission Act, SA 2007, c A-37.2, s 9; AUC Rule 001, Rules of Practice, s 11.

- Government of Alberta, Price cap to protect consumers from volatile electricity prices (Edmonton: 22 November 2016), online: <https://www.alberta.ca/release.cfm?xID=4487283D35A59-070B-5A1F-76A7FB63D2CA149D>.

- Alta Reg 159/2009.