Changes in Ontario’s electricity rates have been the subject of considerable public attention and discussion recently, with many analysts noting that residential rates have approximately doubled over the last decade.1 But how do recent increases compare to previous decades and also to changes in rates in other jurisdictions? This Policy Brief provides a historical and comparative perspective on the development of Ontario’s electricity rates from 1970 to 2015, the modern era of electricity in the province, which has seen the addition of commercial-scale nuclear generation capacity, creation of a wholesale power market, as well as newer initiatives to decarbonize generation and reduce consumption. Using statistical data from several sources, the Policy Brief finds evidence that (i) there have been multiple historic episodes of rapid short-term rate increases followed by periods of slower growth, (ii) U.S. states with similar generation profiles as Ontario have also experienced long-term rate increases, (iii) electricity costs in Ontario have risen at a more dramatic rate in the past decade than in prior decades, and (iv) the need to stimulate investment in new generation capacity after a significant decline in provincial capacity in the late 1990s was one contributing factor.

Electricity Pricing in Ontario

To compare electricity rates and trends in Ontario against other provinces, this analysis uses Statistics Canada data from an annual survey of utilities, “The Annual Electricity Supply and Disposition Survey”, which has been compiled each year since 1955 under various titles. Although there are some limitations to the data, it is the only source of comparable electricity sales and generation data across all provinces.2 The U.S. Energy Information Administration publishes an identical dataset on state-level electricity costs and rates, facilitating comparisons between Canadian and U.S. electricity rates.

The Statistics Canada survey data enables a close proxy for average electricity rates to be calculated for each province – average utility revenue per kilowatt hour (kWh) – based on utilities’ electricity revenues and the quantity of electricity sold in a province.3 Figures 1 and 2 depict the average revenue per kilowatt hour ($/kWh) in Ontario from 1970 to 2015 for both residential customers and for all customer classes in nominal and real terms. The trends in the two figures are qualitatively similar: rates increased gradually from the early 1970s to the early 1990s, remained relatively flat in real terms until around 2008, and then increased sharply after 2008. The compound annual growth rate (CAGR) for the residential and total electric utility revenue per kWh in real terms (2010 dollars) over the 1970-2015 period was 1.4 per cent and 1.7 per cent, respectively.

Figure 1 Ontario Electric Utility Revenue per kWh for Residential Customers

Source: Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Supply and Disposition of Electric Power (2005-2015).

Figure 2 Ontario Electric Utility Revenue per kWh for all Customer Classes

Source: Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015).

It is notable that prior decades have also witnessed episodes of rapid short-term real rate increases. Figure 3 charts the two-year moving average of the annual percentage change in average electric utility revenue per kWh (in real terms), revealing episodes where rates have increased, decreased or remained relatively stable over time. The data indicate several periods of substantial annual real appreciation: the late 1970s, early 1990s, and the last decade. For instance, following the completion of Unit 2 at the Darlington Nuclear Power Station in 1990, utility revenue per kWh increased by 6 per cent in real terms on average each year from 1990 to 1993 – prompting the government to institute a rate freeze that was continued for nearly a decade. The accumulation of significant electricity sector debt and the need to undertake infrastructure renewal eventually led a new government to lift the rate freeze in April 2004. There have also been intermittent episodes of decreases in average real electric utility revenue per kWh, partly driven by nominal rate reductions or freezes.

Figure 3 Percentage Change in Ontario Electric Utility Revenue per kWh

Source: Authors calculation. Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Supply and Disposition of Electric Power (2005-2015); Cansim Table 326-0021.

As a further benchmark comparison, Figure 4 compares the growth in real electric utility revenue per kWh to growth in gasoline prices since 1970. Growth in average utility revenue per kWh follows a steady and increasing trend for the bulk of the period of time. This trend becomes noticeably steeper following 2009, with a compound annual growth rate of 3.8 per cent. The price of gasoline, on the other hand, has also followed a similar rising, yet volatile, trend upwards, as is observed with the electricity measure.

Figure 4 Electric Utility Revenue per kWh, Gasoline Prices and Consumer Price Index (1970=100)

Source: Authors’ calculation. Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Supply and Disposition of Electric Power (2005-2015); Cansim Table 326-0021.

Electricity Price Trends in Other Jurisdictions

How does Ontario’s evolution of electricity rates compare to other provinces within Canada and to U.S. states? Figure 5 depicts average electric utility revenue per kWh for residential customers from 1970 to 2015 in real terms. At the beginning of the period, residential electricity rates in Ontario were on par with Canada’s two low-rate jurisdictions of Quebec and Manitoba, which have experienced very little growth in real terms over more than three decades. However, by 2015 Ontario had become one of the highest residential rate provinces, along with Prince Edward Island and Nova Scotia. Only Saskatchewan has undergone a similar transition from a relatively low-priced regime to a high-priced regime over the same period.

Figure 5 Average Residential Electricity Revenue per kWh (2010 dollars)

Source: Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015).

Figure 6 shows the growth rate of residential electricity rates for each province indexed to 1970 (in real terms). The majority of provinces have seen no significant growth in real residential electric utility revenue per kWh over the 1970-2015 period. In fact, some have experienced real reductions since 1970. Besides Ontario, only Alberta, Nova Scotia and Saskatchewan – all of which have had significant coal-fired power generation – had residential electricity rates in 2015 that were higher than in 1970 in real terms.

Figure 6 Index of Average Residential Electricity Revenue per kWh (2010 dollars) (1970=100)

Source: Authors calculation. Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015).

Simple comparisons of electricity rates and trends across provinces can be misleading, however, since economic conditions and power generation resources and technologies vary dramatically. Ontario is the largest and most economically diverse province in the country, and its electric utility sector is the largest with employment over 35,000 workers. Ontario also has a unique generation supply mix which has changed substantially since 1970. Figure 7 illustrates electricity generation profiles across provinces at four points in time (1970, 1985, 2000 and 2015). Ontario’s generation fuel mix has evolved from a split between hydro and coal in 1970 to a more diverse mix of nuclear, hydro, renewables, and natural gas in 2015. Jurisdictions with a relatively low cost of electricity, such as Manitoba and Quebec, have had a stable supply mix dominated by low-cost hydro-electric generation.

Figure 7 Share of Provincial Electricity Generation by Fuel Type

Source: Authors calculation. Statistics Canada: Electric Power Statistics, Volume 2 (1970, 1985); Electric Power Generation, Transmission and Distributions (2000); Annual Electricity Supply and Disposition Survey (2015).

Note: The renewable category includes electricity generated from wind, solar, tidal, and biogas sources.

While Ontario does not have an obvious comparator among the natural resource-based economies of other Canadian provinces, the composition of its economy with a focus on services and manufacturing is more comparable to some U.S. states. Likewise, the technology profile of electricity generation is more closely matched to some states than to other Canadian provinces. California, Michigan, New York and Ohio are similar to Ontario in terms of industrial composition and relative share of the national economy.

Figure 8a plots annual electric utility revenue per kWh for residential customers for these four states and for Ontario over the 1970-2015 period.4 They all depict an upward slope and, with the exception of the last two years, exceed Ontario’s electricity revenue per kWh in each year. Compound annual growth rates for the four states range between 3.7 per cent and 4.5 per cent, which is two to three times the growth rate for Ontario over this period. Figure 8b depicts the growth rates for Ontario and these four states since 1970. Ontario’s growth rate closely matched that of New York State until around 2008, after which it diverged upwards. While electricity rates have grown more slowly in Michigan and Ohio, California’s rates have generally grown faster than Ontario throughout the 45 year period. An alternative comparison examines U.S. states that have a similar electricity generation technology profile as Ontario. In 1990, Ontario had a fuel mix of generated electricity that included 46 per cent nuclear, 31 per cent hydro and 22 per cent coal. Arizona, New Hampshire, South Carolina, and Virginia had similar profiles with respect to fuel sources in 1990 (see Table 1). No state is a perfect match for Ontario, but all four had a heavy reliance on coal and nuclear power.

Figure 8a Electric Utility Revenue per kWh for Residential Customers for Ontario and Selected States

Source: Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015). Energy Information Administration: State Energy Data System (SEDS).

Figure 8b Index of Electric Utility Revenue per kWh for Residential Customers (Dollars adjusted for PPP, 1970=100) for Ontario and Selected States

Source: Author’s calculation. Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015). Energy Information Administration: State Energy Data System (SEDS).

Figure 9a plots electric utility revenue per kWh for residential customers for these states, revealing a convergence in electricity rates (on a PPP exchange rate-calculated basis) with Ontario until 2012, with the exception of New Hampshire, which experienced a more rapid escalation. Figure 9b illustrates the trend growth pattern since 1970 for the same jurisdictions and shows how Ontario’s growth was on par with these states until the mid-1990s, but then took on a distinctly steeper path after 2000.

Table 1 Share of Electricity Generation by Fuel Type in Ontario and Selected States in 1990

| Ontario | Arizona | New Hampshire | South Carolina | Virginia | |

|---|---|---|---|---|---|

| Coal | 22 per cent | 51 per cent | 24 per cent | 33 per cent | 45 per cent |

| Nuclear | 46 per cent | 33 per cent | 33 per cent | 60 per cent | 45 per cent |

| Hydro | 31 per cent | 12 per cent | 15 per cent | 5 per cent | 3 per cent |

| Natural Gas | 0 per cent | 4 per cent | 0 per cent | 1 per cent | 2 per cent |

| Renewables | 0 per cent | 0 per cent | 9 per cent | 2 per cent | 3 per cent |

Figure 9a Electric Utility Revenue per kWh for Residential Customers for Ontario and Selected States

Source: Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015). Energy Information Administration: State Energy Data System (SEDS).

Figure 9b Index of Electric Utility Revenue per kWh for Residential Customers for Ontario and Selected States (Dollars adjusted for PPP, 1970=100)

Source: Author’s calculation. Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015). Energy Information Administration: State Energy Data System (SEDS).

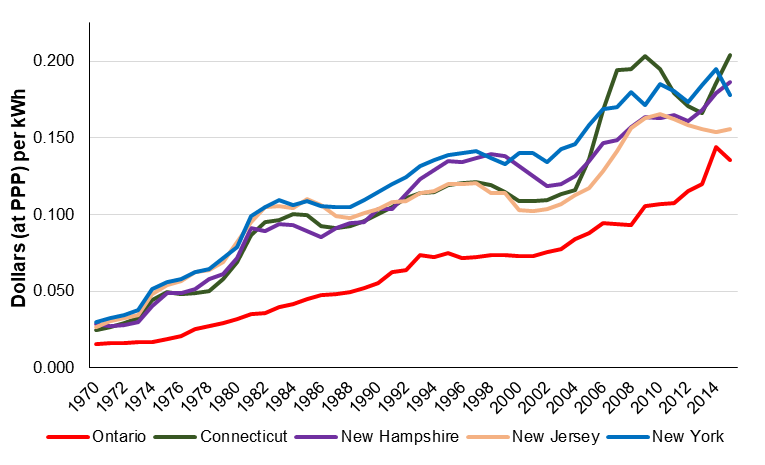

By 2015, Ontario’s fuel mix had changed substantially to 59 per cent nuclear, 23 per cent hydro, 10 per cent natural gas, and 8 per cent renewable power (in terms of MWh generated) – similar to Connecticut, New Hampshire, New Jersey and New York. A key distinction for this set of comparators is that these states use little or no coal as a fuel for electricity generation. While they have not adopted coal moratoriums, as in Ontario, they have all seen dramatic decreases in the share of electricity generated from coal. For instance, Connecticut has reduced its share of coal from 24 per cent of electricity generated to less than 2 per cent in 2015. In addition, these states all rely on a significant amount of nuclear power, like Ontario (see Table 2 for a comparison of generation profiles).

Ontario’s average electric utility revenue per kWh (at PPP exchange rates) is the lowest among this comparator group over the whole period (see Figure 10a). In fact, New York had rates in 1970 that were double that of Ontario. Similar to Figure 9b, the growth trend depicted in Figure 10b is comparable to the four states until around the year 2003, after which Ontario’s growth rate accelerates when the rate freeze was lifted.

Table 2 Share of Electricity Generation by Fuel Type in Ontario and Selected States in 2015

| Ontario | Connecticut | New Hampshire | New Jersey | New York | |

|---|---|---|---|---|---|

| Coal | 0 per cent | 2 per cent | 5 per cent | 2 per cent | 2 per cent |

| Nuclear | 59 per cent | 47 per cent | 47 per cent | 45 per cent | 32 per cent |

| Hydro | 23 per cent | 1 per cent | 6 per cent | 0 per cent | 19 per cent |

| Natural Gas | 10 per cent | 46 per cent | 30 per cent | 50 per cent | 41 per cent |

| Renewables | 8 per cent | 4 per cent | 11 per cent | 3 per cent | 5 per cent |

Figure 10a Electric Utility Revenue per kWh for Residential Customers for Ontario and Selected States

Source: Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015). Energy Information Administration: State Energy Data System (SEDS).

Figure 10b Index of Electric Utility Revenue per kWh for Residential Customers for Ontario and Selected States (Dollars adjusted for PPP, 1970=100)

Source: Author’s calculation. Statistics Canada: Electric Power Statistics, Volume 2 (1970-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015). Energy Information Administration: State Energy Data System (SEDS).

While much has been said about Ontario’s increasing electricity rates, the data presented here demonstrates how the selection of comparator jurisdictions is imperative for a proper analysis. Ontario does not have the highest electricity rates in North America, despite having some of the highest rates in Canada. No province is like Ontario, and when one examines more comparable jurisdictions in the U.S., however, it becomes apparent how Ontario’s rates and rate growth is on par with not only bordering jurisdications that we compete with but also those that reflect the diverse generation portfolio of the province.

Electricity Generation Capacity Trends

While the focus of this Policy Brief is on documenting trends in electricity rates, the Statistics Canada survey data also contains information on annual generation capacity in each province. Figures 11 and 12 show generation capacity and growth rates for Ontario and other provinces since 1970. It is notable that Ontario experienced a significant 19.8 per cent decline in capacity – from a peak of approximately 37,000 MW in 1995 to 30,000 MW by 2000 – following the closure of eight nuclear generating units at the Pickering Nuclear Generating Station and the Bruce Nuclear Generating Station. This led to an overall capacity shortfall in the province, which motivated a subsequent push to rapidly develop new capacity, notably in gas-fired generation and later in renewable energy, reflected in above average annual capacity growth rates after 2000. The U.S. northeast and southern Canada blackout in 2003 further reinforced policies directed at stimulating private sector investment in new generation capacity. The rapid escalation in Ontario’s rates after the mid 2000’s, when much of this new capacity was completed and included in rates, reflects the economic impact of these prior capacity-building policies.

Figure 11 Provincial Power Generation Capacity (1970=100)

Source: Statistics Canada: Electric Power Statistics, Volume 2 (1990-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015).

Figure 12 Compound Annual Five-Year Growth Rates in Provincial Generating Capacity

Source: Statistics Canada: Electric Power Statistics, Volume 2 (1990-1996); Electric Power Generation, Transmission and Distributions (1997-2004); Annual Electricity Supply and Disposition Survey (2005-2015)

Conclusion

There is no doubt that electricity rates in Ontario have appreciated significantly over the past decade, yet simple comparisons can be misleading. Ontario’s mix of power generation technologies, natural resource endowments, and economy are unique, making other provinces poor comparators. Comparisons with similar U.S. states can be more informative, and these suggest that while rates have increased they remain relatively moderate. Finally, the need to add generating capacity, replace old coal-fired generation capacity with cleaner burning natural gas plants, and upgrade ageing transmission infrastructure, were also important drivers.

* Associate Professor, University of Western Ontario

- For a detailed discussion and analysis of recent electricity rate trends in Ontario, see ‘The Economic Cost of Generation in Ontario’, Ivey Energy Policy and Management Centre, 2017.

- The survey is administered as part of the Integrated Business Statistics Program, and completing it is mandatory for all utilities. Survey data is found in Statistics Canada Table 127-008. The Ontario Energy Board’s Utility Yearbook has similar data yet this publication is available only since 2005, and comparable publications do not exist for other provinces. The Statistics Canada data differs from the OEB data in a number of ways. For instance, the Statistics Canada reporting rate varies during the survey period, and it defines certain customer classes differently from the OEB. Nevertheless, the two data series correlate at 88 per cent, suggesting that the Statistics Canada data is a reasonable representation of Ontario electricity costs.

- Data on electricity revenues and kWh sales has been included in each iteration of the Statistics Canada survey on the electricity sector and provide the longest across-province proxy for electricity rates available in Canada. Utility electricity revenues are defined as the dollar amount of electric energy that is sold to all classes of final customers by distribution utilities. The survey asks, “What was the value of electricity delivered to the following types of end-use consumers?” and distinguishes between residential, farms, industrial, and other types of consumers. The survey asks an identical question with respect to the volume of electricity sold to end-use customers.

- Information on state average electricity rates is available from the U.S. Energy Information Administration’s State Energy Data System. The data series is adjusted for purchasing power parity (PPP) using exchange rates from the Organization for Economic Cooperation and Development.