Alberta is the fastest growing jurisdiction for renewable power development in Canada. Over the past decade, the province has emerged as a national leader in the renewable energy space because of: (i) the strength of its wind and solar resources, (ii) its unique deregulated wholesale electricity market, (iii) government incentives provided under the market-based Technology Innovation and Emissions Reduction[2] (TIER) regime and (iv) an abundance of electricity offtakers. The Electricity Statutes (Modernizing Alberta’s Electricity Grid) Amendment Act, 2022[3] (Bill 22) received royal assent in Alberta earlier this year and its innovative provisions are expected to support the continued growth of renewable power development in the province when it comes into force by the end of 2022 or early 2023, at the same time as the related changes to the regulations are brought into force.

Renewable developers, offtakers and other market participants need to be aware of the following key developments in the Alberta renewable energy industry.

1) GROWTH IN DEMAND FOR POWER PURCHASE AGREEMENTS (PPAs) FROM PRIVATE OFFTAKERS

Market activity for private PPAs in Alberta has increased significantly in recent years, as a strategy used by numerous offtakers to meet their environmental, social and corporate governance (ESG) objectives. Alberta’s PPA market continued to be active throughout the COVID-19 pandemic, despite reduced power demand and a depressed forward power price curve over this period.

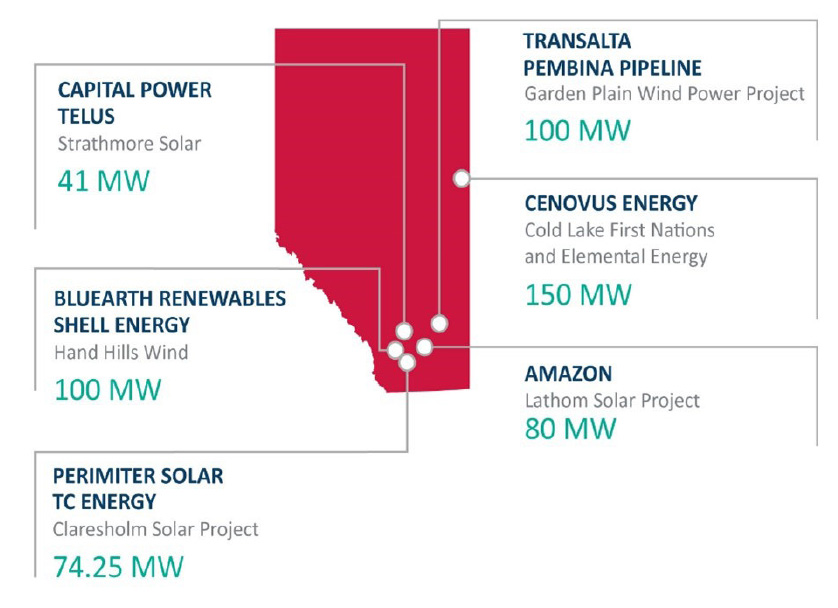

While Alberta has an active PPA market, information is limited as private, bilateral PPA transactions are often not publicly disclosed. Table 1 in Appendix A below shows a select number of publicly announced private PPA transactions in Alberta in 2021, with offtakers from the telecommunications, energy and retail industries, including TELUS,[4] Shell Energy,[5] Pembina Pipeline Corporation,[6] Cenovus Energy Inc.,[7] TC Energy[8] and Amazon.[9]

The key benefits to renewable project developers of entering into PPAs are revenue certainty and financeability. Without a PPA, a generator must sell electricity at the variable Alberta pool price and find a purchaser for environmental attributes, such as carbon emission offsets (which also vary in price). Not having a PPA can make it difficult to secure project financing to develop a renewable project in a variable market-price environment and in the absence of subsidies or other regulatory incentives. The strong and growing demand for renewable power in Alberta by corporate offtakers via PPAs is expected to drive growth in renewable power generation and translate into significant growth for the sector.

2. GOVERNMENT PROCUREMENTS: AN ASSET TO PROJECTS, BUT NOT NECESSARY

Government offtakers are particularly attractive for off-balance sheet-financed projects. Such projects allow developers to reliably source project-level debt financing on the back of a long-term offtake contract with a creditworthy governmental counterparty.

In 2017 and 2018, the Alberta Renewable Electricity Program (REP) accelerated renewable project development in Alberta by awarding PPAs for 12 renewable wind projects (see Table 2 in Appendix A below), representing a total of 1,359 megawatts (MW) of incremental nameplate renewable generation capacity for the province. REP selected these projects from a pool of 59 projects for which bids were submitted (as reported by the Alberta Electric System Operator (AESO)).[10] Four of these projects — Whitla Wind, Castle Rock Ridge Wind, Riverview and Windrise — are already in operation. The remaining projects are under development and many expect to begin operations later this year.[11]

Alberta Infrastructure also ran a solar procurement in 2018 that resulted in the awarding of three 20-year contracts for 146,431 megawatt-hours (MWh) annually (see Table 3 in Appendix A below).[12] The Hays and Jenner solar projects were completed by their respective developers in 2021, and the Tilley project is scheduled for completion later this year.[13]

While the REP resulted in benchmark pricing and terms, which are otherwise generally lacking in the private PPA market, it was discontinued in 2019. Following its success, the Government of Canada followed suit and issued a request for information in April 2020 indicating its intention to procure one or more 20-year PPAs for 200,000 to 280,000 MWh of Alberta renewable power annually. On January 7, 2021, the federal government, through Public Services and Procurement Canada (PSPC), launched requests for proposals (RFPs) to purchase clean electricity in Alberta to power federal operations in the province.[14] PSPC did not receive responses to these RFPs by the solicitation close in February 2021. As a result, it is seeking to move ahead with a retail-focused procurement strategy instead, also through an RFP process. In this new RFP process, PSPC is seeking prospective proponents to commit to the supply of approximately 255,000 MWh of clean electricity annually, commencing January 1, 2023.

Although government procurements have contributed to the growth of renewable generation in Alberta, the province’s renewable energy sector is not dependent on such programs for continued growth. Rather, demand is expected to continue as: (i) renewable energy generation costs become increasingly competitive with other sources of electrical generation on the provincial grid and (ii) different types of investors look to add renewable energy assets to their portfolios to achieve their ESG objectives. For instance, in 2020, Copenhagen Infrastructure Partners invested in the Travers Solar project in southern Alberta, and in 2021, Amazon signed a PPA to purchase up to 400 MW of power from the project. This project will be Canada’s largest solar project and one of Alberta’s largest producers of environmental attributes under the TIER regime. The project’s investors are prepared to develop the solar plant based solely on merchant revenues and its developers expect it will be completed in 2022.[15]

3. REGULATORY UPDATES, UNCERTAINTIES AND RELATED FINANCIAL RISKS

Alberta’s unique competitive market framework presents opportunities and challenges for developers. The commitment by the Alberta government to continue with an energy-only market and to support market-based solutions provides clarity to developers. Permitting self-supply with export (“self-supply”) — which refers to a facility’s ability to generate its own power for its own use and to sell excess power to the grid — also presents a meaningful opportunity for renewable power producers looking to partner with large consumers through on-site generation.

Self-supply has grown in popularity due to high grid-connection costs and reduced mid-scale generation costs. Previously, under the Electric Utilities Act[16] and the Hydro and Electric Energy Act[17], self-supply was prohibited in Alberta with the exception of municipally-owned generators, small renewable generators and co-generation power plants that have obtained an Industrial System Designation (ISD) approval from the Alberta Utilities Commission (AUC). Due to increased interest in self-supply and the broadly applicable prohibition under the legislation, the AUC submitted a discussion paper to the Department of Energy (DOE) on self-supply considerations in 2019. This paper and related engagement efforts resulted in the amendments reflected in Bill 22, which will allow for unlimited self-supply with export when the amendments come into force. On May 31, 2022, Bill 22 received royal assent and it is expected to come into force at the end of 2022 or early 2023 to coincide with accompanying amendments to the Transmission Regulation.[18]

Despite regulatory clarity on permitting self-supply with export, there remains uncertainty with respect to applicable tariff rates, and certain key details of Alberta’s regulatory framework which the regulators continue to review:

- AESO tariff: In 2020–2021, the AESO consulted on proposed changes to bulk and regional tariff design and submitted a formal application to the AUC in October 2021 for tariff changes. The application also proposes a Modernized Demand Opportunity Service intended to accommodate greater market participation by energy storage resources. The AESO’s proposed changes are still under review by the AUC, with a decision expected later in 2022. The evolving tariff framework in Alberta has direct implications on the costs required to connect to Alberta’s grid and, thus, remains a key source of financial risk for renewable project proponents.

- Distribution system inquiry: In 2020, the AUC inquired into how Alberta’s distribution system should adapt to market change. The AUC initiated the inquiry in response to the rapid advancement in technology such as smart metering, battery storage and distributed energy resources. Following the inquiry, the AUC released a report in 2021 which addresses, among other issues, the need for a collaborative effort among the government of Alberta, AUC, AESO, electric distribution facility owners, consumers and alternative technology providers to build up a long-term plan that is consistent with Alberta’s long-term strategic framework. The AUC also identified regulatory barriers surrounding the adoption of these new technologies and indicated the intention to take actions. The eventual outcomes of this initiative, which could drive regulatory, policy and legislative changes, could have material impacts on renewable projects, many of which seek to connect to the distribution system.

Regulators have acknowledged these key issues and are seeking to resolve them with stakeholder input, but certainty is not expected for months, if not years.

CONCLUSION

Alberta’s renewable power market continues to provide considerable opportunities for both developers and offtakers. The expansion in private sector PPA activity, government procurement opportunities and the increased regulatory clarity provided through the legislative changes contained in Bill 22 stand as bellwethers for growth in 2022 and beyond.

APPENDIX A

Table 1: Select Publicly Available Private PPA Activity 2020-2021[19]

Table 2: REP Government of Alberta Procurement Results – Rounds 1, 2 and 3

Table 3: Government of Alberta Solar Procurement

- This article is a revised version of Paula Olexiuk, Jesse Baker & Dana Saric, “Pursuing renewable projects in Alberta in 2021: 5 things you need to know” (8 December 2020), online: Osler <www.osler.com/en/resources/regulations/2020/pursuing-renewable-projects-in-alberta-in-2021-5-things-you-need-to-know>.

* Paula Olexiuk is a partner in Osler’s Corporate department and Co-Chair of the firm’s Construction and Infrastructure group. Paula’s practice focuses on the construction, development, acquisition and divestiture of energy and infrastructure projects in Canada and abroad.

John Gormley is an associate in Osler’s Regulatory, Environmental, Indigenous & Land group. His practice focuses on environmental, regulatory and Indigenous law issues that affect natural resource and energy development projects.

Bukola Agbede is an articling student in Osler’s Calgary office. Prior to joining Osler, she interned at the corporate finance department of the British Columbia Securities Commission and practiced corporate law at a leading Nigerian law firm.

- Alta Reg 133/2019.

- SA 2022, c 8.

- Capital Power, “Fact Sheet | Strathmore Solar” (last modified 20 July 2022), online (pdf): <www.capitalpower.com/operations/strathmore-solar/>.

- BluEarth Renewable, “BluEarth Renewables Signs Long-Term Power Purchase Agreement with Shell Energy for Hand Hills Wind Project in Alberta” (8 April 2021) online: <bluearthrenewables.com/shell-ppa/>.

- Transalta, “TransAlta and Pembina Pipeline Announce 100 MW Renewable Power Purchase Agreement and Launch of the Garden Plain Wind Project” (3 May 2021), online: <transalta.com/newsroom/transalta-and-pembina-pipeline-announce-100-mw-renewable-power-purchase-agreement-and-launch-of-the-garden-plain-wind-project/>.

- Cenovus, “Cenovus to buy renewable power from Cold Lake First Nations, Elemental Energy partnership” (22 July 2021), online: <www.cenovus.com/News-and-Stories/News-releases/2021/2267275>.

- Perimeter Solar Inc., “Canada’s Largest Private Power Purchase Agreement Signed between Perimeter Solar and TC Energy” (30 September, 2019), online (pdf): <www.cansia.ca/uploads/7/2/5/1/72513707/perimeter_press_release_tc_energy_ci_agreement_09-27-19_rl_final.pdf>.

- Government of Alberta, “Lathom Solar Project” (last visited 9 November 2022), online: <majorprojects.alberta.ca/details/Lathom-Solar-Project/4423>.

- AESO, “REP results” (last visited 9 November 2022), online: <www.aeso.ca/market/renewable-electricity-program/rep-results/>.

- Capital Power, “Whitla Wind” (last visited 9 November 2022), online: <www.capitalpower.com/operations/whitla-wind/>; Enel Green Power, “Castle Rock Ridge Wind Farms” (last visited 9 November 2022), online: <www.enelgreenpower.com/our-projects/highlights/castle-rock-ridge-wind-farms>; Government of Alberta, “Windrise Wind Power Project” (last visited 9 November 2022), online: <majorprojects.alberta.ca/details/Windrise-Wind-Power-Project/4444>; “Buffalo Atlee Wind Farm 1/2/3/4” (last visited 9 November 2022), online: <buffaloatlee.com>; EDF Renewables, “Cypress (1&2) Wind” (last visited 9 November 2022), online: <www.edf-re.com/project/cypress-wind/>; Stirling Wind Project, “About the Stirling Wind Project” (last visited 9 November 2022), online: <stirlingwind.com>; “Jenner Wind Power Project” (last visited 9 November 2022), online: <jennerwind.com/>.

- Government of Alberta, “Alberta-based solar power on the rise” (15 February 2019), online: <www.alberta.ca/release.cfm?xID=625497BB07A33-C042-927C-E60C5A0CF7F5D8D0>.

- Government of Alberta, “Canadian Solar Solutions Solar Plants (Hays, Jenner, and Tilley)” (last visited 9 November 2022), online: <majorprojects.alberta.ca/details/Canadian-Solar-Solutions-Solar-Plants-Hays-Jenner-and-Tilley/3830>.

- Paula Olexiuk, Carson Wetter & Dana Saric, “Canada launches clean electricity procurement process with emphasis on Alberta solar” (18 January 2021), online: Osler <www.osler.com/en/resources/regulations/2021/canada-launches-clean-electricity-procurement-process-with-emphasis-on-alberta-solar>; Public Services and Procurement Canada, News release, “Requests for Proposal launched for purchase of clean electricity in Alberta” (7 January 2021), online: <www.canada.ca/en/public-services-procurement/news/2021/01/requests-for-proposal-launched-for-purchase-of-clean-electricity-in-alberta.html>.

- The Canadian Press, “Amazon to purchase power from massive southern Alberta solar farm” CBC (24 June 2021), online: <www.cbc.ca/news/canada/calgary/alberta-amazon-solar-energy-power-vulcan-travers-1.6077152>; Government of Alberta, “Travers Solar Project” (last visited 9 November 2022), online: <majorprojects.alberta.ca/details/Travers-Solar-Project/3656>.

- SA 2003, c E-5.1.

- RSA 2000, c H-16.

- Alta Reg 86/2007.

- Canada Energy Regulator, “Market Snapshot: Corporate power purchase agreements add renewables in Alberta” (last modified 21 June 2022) online: <www.cer-rec.gc.ca/en/data-analysis/energy-markets/market-snapshots/2022/market-snapshot-corporate-power-purchase-agreements-add-renewables-in-alberta.html>.